During my interaction with Project Management Professional (PMP)® Certification aspirants, often I see that they take the Point of Total Assumption as a confusing concept. I observed that there are lots of misunderstandings and confusions that need clarity. Though not a crucial question from the PMP® exam point of view, it still needs a detailed discussion. In this blog, I will address the puzzling PTA concept with simple to understand examples.

This concept is only related to fixed-price incentive fee contracts. It refers to the amount above which the seller bears all the losses of an additional cost overrun. The concept works when:

Let’s look at a few terms before we get into the meaning of PTA.

Target Cost: This is the estimated budget, which the seller has planned for delivering the given project. It is like a project budget. This target cost is shared with the buyer, and the process of estimating the project budget is also transparent.

Target Fee: This is the fee which the seller wants to charge for the work he is doing. It is the planned fee, and the actual fee will depend upon how well the seller manages the project (cost overruns)

Target Price: It is the price the buyer is looking towards. And, it is a sum total of Target Cost + Target Fee, both seller and buyer use this as a benchmark. If the final project cost less than this price, the buyer and seller will share the profit as per the profit-sharing agreement. If the price goes beyond the target price, buyer and seller share the cost as per cost-sharing agreement (subject to the maximum ceiling of the selling price)

Share ratio: There are two types of ratio:

Let’s look at the PTA formula:

PTA = (Ceiling Price – Target Price) / Buyer’s Share Ratio + Target Cost

Let’s see how to calculate PTA, For PTA calculation I am taking the example from Rita Mulcahy’s PMP® Exam Prep Eighth Edition page no 480.

| Target Cost | 150,000 |

| Target Fee | 30,000 |

| Target Price | 180,000 |

| Sharing Ratio (Cost Overrun Sharing Ratio) | 60/40 |

| Ceiling Price | 200,000 |

Let’s calculate PTA for this

PTA = (Ceiling Price – Target Price) / Buyer’s Share Ration + Target Cost

PTA = (200,000 – 180,000) /. 60 + 150,000

PTA = 183,333

What does it mean?

It means the cost of development should not touch the Point of Total Assumption (PTA) (183,333). And, it should be the target of the seller. If it touches PTA then all further cost overrun the seller has to pay. Looks theoretical? Let’s see what number speaks, here I have created seven scenarios of the actual cost. It is starting from target cost equal to actual cost. We are only discussing cost overrun case, we are not discussing profit-sharing here.

| S.No | Actual Cost | Actual Price (Actual Cost + Target Fee) | Price Overrun (Actual Price – Target Price) | Buyer’s Share (60% of Price Overrun till PTA) | Buyer’s Payout (Target Cost + Buyer Cost Overrun Share, not more than Ceiling Price) | Seller’s Profit (Buyer Payout – Actual Cost) |

| 1 | 150,000 | 180,000 | 0 | 0 | 180,000 | 30,000 |

| 2 | 160,000 | 190,000 | 10,000 | 6,000 | 186,000 | 26,000 |

| 3 | 170,000 | 200,000 | 20,000 | 12,000 | 192,000 | 22,000 |

| 4 | 183,333 | 213,333 | 33,333 | 20,000 | 200,000 | 16,667 |

| 5 | 190,000 | 220,000 | 40,000 | 20,000 | 200,000 | 10,000 |

| 6 | 200,000 | 230,000 | 50,000 | 20,000 | 200,000 | (0) |

| 7 | 210,000 | 240,000 | 60,000 | 20,000 | 200,000 | (-10,000) |

Here are some of the things which you might have observed

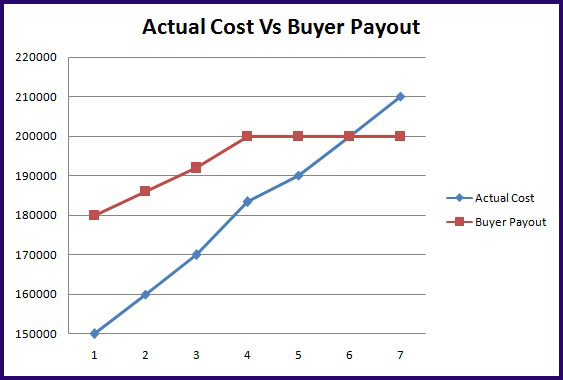

Actual Cost Vs Buyer Payout

This graph shows how profit margin starts shrinking once the seller misses the target price. And margin shrinks further when they reach PTA point. Also, the seller starts making a loss when the actual cost goes more than the ceiling price.

Now I guess it should be easier to understand that if actual cost touches PTA, the seller pays all further cost overruns.

Answer: The buyer pay-out is driven by target price and overrun. Now when we calculated the target price, we used target cost and target fee in driving it. As the seller breach the target price, seller profit (fee) starts reducing, it’s not a cost-reimbursable contract where you get all your cost + fixed fee. It’s a fixed-price incentive fee contract, so your profit goes down as you breach the target price.

Answer: This sometimes looks confusing since we calculate the cost overrun based on the target price. It’s better to understand that after PTA the cost of the buyer reaches the ceiling price, so he does not pay share cost of additional overrun. He is still paying the ceiling price (not target price). If I plot a bar chart of the scenarios discussed in this blog it shows that after PTA point, a scenario no 4 buyers share, for cost overrun is frizzed to 20,000, the seller has to pay all extra money.

Answer: Manage the project in less than the target price. Once a seller breaches the target price his profit starts shrinking.

Answer: No, the profit will be less than the target fee when project costs, raise beyond the target price. Until the buyer is sharing is 100% of the cost overrun.

Answer: We do not see PTA questions coming in PMP® exam very frequently. I hope now you will not just memorize the formula of point of total assumption with lots of assumptions. Drop us a comment or feedback on the blog. You may also share your further queries on the same topic. We would be glad to answer them.

You may also join the discussion on the same in our Discussion Forum

Enroll to our FREE PMP® Certification Introductory Program to learn more about PMP® certification

| Name | Date | Place | – |

| PMP Certification and Training | 17 July – 15 Aug 2025 | Bangalore | More Details |